Find Your Dream Home: Mastering Budgeting with Hamilton & Co., Your Trusted Realtor in Greenville, SC

So, you're itching to plant your roots and buy a home in Greenville, SC? Well, you're in for a treat, but remember, it's not just about signing on the dotted line for the purchase price. But there's more to it!

Budgeting for a home is like putting together a jigsaw puzzle, involving ongoing costs, potential appreciation, and those ever-changing market trends. But fear not! With a bit of guidance from lending partners and a seasoned

realtor in Greenville, SC, you'll be navigating these waters like a pro.

What Home Fits My Budget?

Understanding the code for what home fits within your budget can feel like navigating a maze. But with the right insights and a sprinkle of wisdom from a realtor in Greenville, SC, like Hamilton & Co., you'll find the path is clearer than you think. When looking to buy a home in Greenville, SC, consider not just your current financial situation but also your future plans and potential changes in income or expenses. Here's how you can crack the budget puzzle:

- Evaluate Your Income: Start by taking a hard look at your monthly income. How much of that can comfortably go towards a mortgage without stretching your finances too thin? A common rule of thumb is the 28/36 rule, which suggests that no more than 28% of your gross monthly income should go to housing costs.

2. Consider Total Housing Costs: Remember, it's not just the mortgage. Factor in property taxes, homeowner's insurance, potential HOA fees, and utilities to get a full picture of what you'll be spending each month.

3. Plan for the Unexpected: Life has a way of throwing curveballs at you, so having a buffer in your budget for unforeseen expenses is wise. This could include emergency repairs, maintenance, or even a sudden job change.

4. Future Goals and Lifestyle: Think about your long-term goals and lifestyle preferences. Are you planning for a family, or do you travel frequently? Your home should fit your future as much as your present.

5. Get pre-approved: Before falling in love with a property, getting pre-approved for a mortgage can give you a clear idea of what you can afford. Plus, it shows sellers you're serious and ready to buy.

By keeping these points in mind and working with a trusted realtor like Dan Hamilton, you'll be better equipped to

buy a home in Greenville,

SC, that doesn't just fit your budget but also your dreams and aspirations.

The Real Deal on Home Budgeting

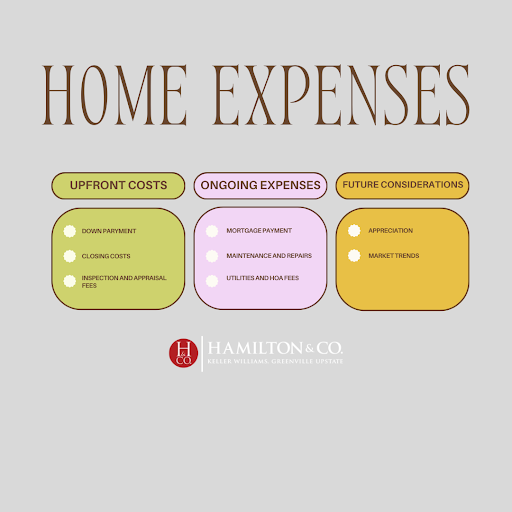

Upfront Costs: The Tip of the Iceberg

- Down Payment: It's the big chunk of change you pay upfront. Think of it as your stake in the game. Most folks aim for 20%, but there are options as low as 3-5% for those who prefer to keep a bit more in their pocket.

- Closing Costs: Surprise! This is the admin fee party, including everything from appraisal fees to title searches. Typically, it's about 2-5% of your home's purchase price, so don't let it catch you off guard.

- Inspection and Appraisal Fees: Before you get the keys, you'll want a pro to take a gander at the place, making sure it's not a lemon. And the appraisal? That's the bank's way of ensuring the price tag matches the home's value.

Ongoing Expenses: The Marathon

- Mortgage Payments: It's the monthly bill that keeps on giving, until, well, it doesn't. Your payment includes the principal, interest, and often, a little extra for taxes and insurance.

- Maintenance and Repairs: Homes have a funny way of needing TLC when you least expect it. Setting aside 1-2% of your home's value annually should keep you covered for those just-in-case moments.

- Utilities and HOA Fees: Lights, water, and sometimes a Homeowners' Association fee for those extra perks like a community pool or snow removal. It all adds up!

Future Considerations: Looking Down the Road

- Appreciation: It's the real estate version of your home hitting the gym and getting buff. Over time, your property's value can increase, which is great news for your investment.

- Market Trends: Keeping an eye on the market is like reading the weather. It helps you anticipate changes and make smart decisions about when to sell or refinance.

Let's face it, diving into the

home buying process without a solid budget is like sailing without a compass—you might eventually get where you're going, but it'll be a heck of a bumpy ride. Budgeting ensures you're financially prepared not just for the purchase but for the journey of homeownership that follows.

So, ready to take the plunge and buy a home in Greenville, SC? Reach out to Hamilton & Co. They're more than just a

realtor in Greenville, SC; they're your guide to making informed, confident decisions in your home-buying adventure. Because at the end of the day, it's not just about finding a house; it's about discovering your home.